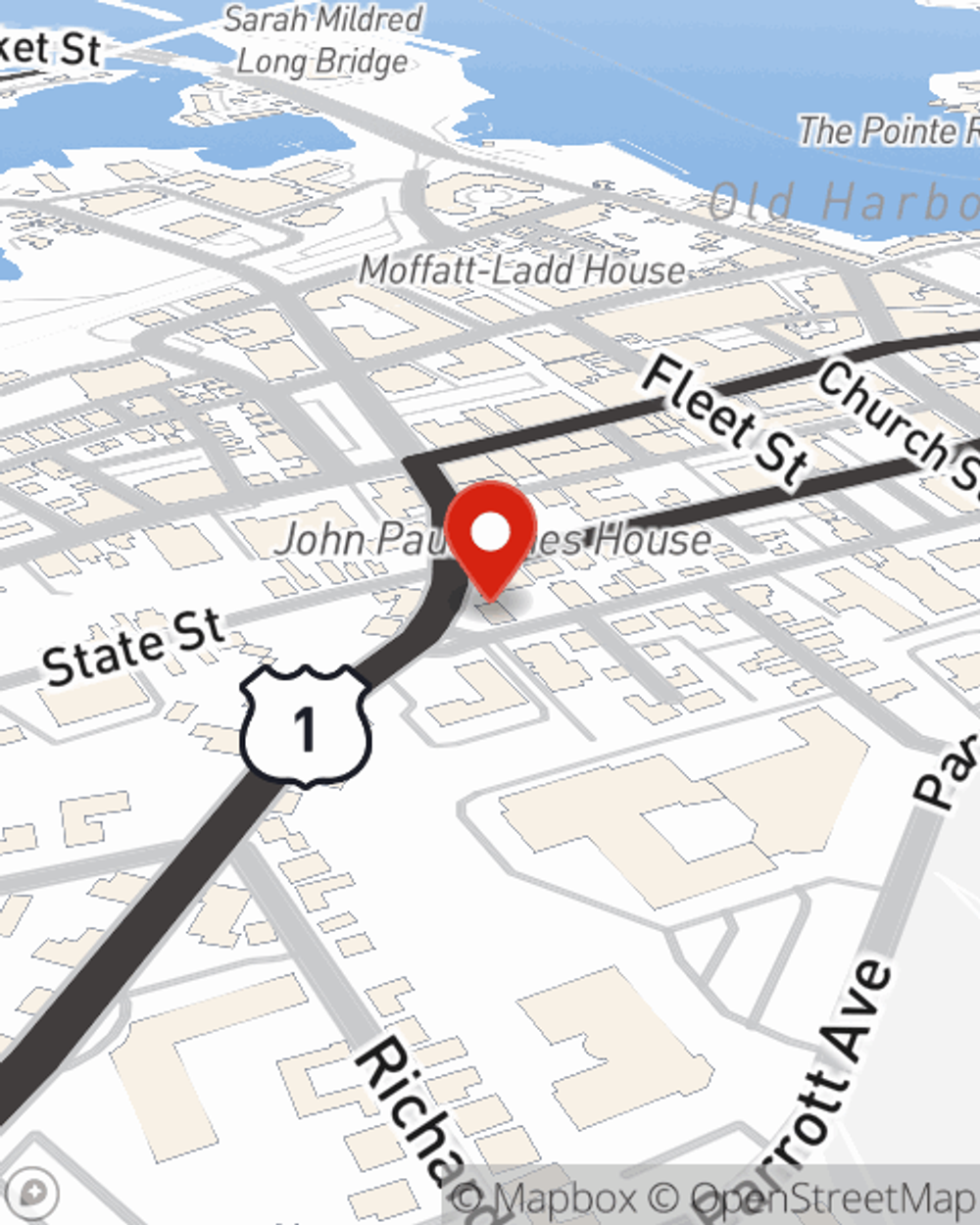

Business Insurance in and around Portsmouth

Calling all small business owners of Portsmouth!

Helping insure small businesses since 1935

- Greenland

- New Castle

- Rye

- Newington

- Dover

- Kittery

- Stratham

- Exeter

- North Hampton

- York

- Hampton

- Seabrook

- Manchester

- New Hampshire

- Maine

Your Search For Excellent Small Business Insurance Ends Now.

Operating your small business takes creativity, hard work, and excellent insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, extra liability coverage, and more!

Calling all small business owners of Portsmouth!

Helping insure small businesses since 1935

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a farm supply store, an appliance store, or a bakery, having the right protection for you is important. As a business owner, as well, State Farm agent Aileen Dugan understands and is happy to offer personalized insurance options to fit your business.

Call Aileen Dugan today, and let's get down to business.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Aileen Dugan

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.